Sector Update / Consumer Discretionary / Click here for full PDF version

Author(s): Kevie Aditya, Elbert Setiadharma

- We recently hosted a conference call with Indonesian Shopping Centers Tenants Association's (HIPPINDO) representatives.

- With Covid-19 cases remain high, malls traffic remain soft (c.30% of normal capacity) with F&B and selective fast fashion stores as winners.

- Maintain Neutral as opex efficiency benefit may be offset by worse than expected inventory clearance. ACES remain our preferred pick.

Traffic remains soft despite malls re-openings

While almost all malls across Indonesia have re-opened, traffic remains soft especially in first-tier cities (i.e. Jakarta and Surabaya), estimated at around 30% of normal (with 50% capped capacity), albeit better at around 50-60% (no capped capacity) in second (i.e. Balikpapan) and third-tier cities (i.e. Cirebon). There wasn't any major excitement during reopening compared to neighbouring countries like Thailand (see our previous report ). We believe this was due to persistently high Covid-19 cases as mid-upper segment is not confident enough to visit malls (despite having better purchasing power), while mid-lower segment's purchasing power was badly hit as many experienced significant pay cut. Also worth noting, non-malls (i.e. traditional markets, street hawkers) were notably more crowded than malls.

Time to re-focus on brands

Better crowds were seen in the F&B establishments and selective fast fashion stores with notable brands are having its mid-year sale (i.e. Zara). Moreover, Hippindo also seeing the shift to online shopping (due to Covid-19) as positive, as existing offline retailers have better online infrastructure, as well as brand equity to compete with other online retailers. Nonetheless, they have seen online purchases to start trending down from its peak in Apr-May as some customers shifted to offline shopping when malls started to reopen.

Cost cutting is still going strong

As Covid-19 hits retailers hard, many smaller players were shutting down their businesses while bigger players are considering scaling down its store size. As such, we believe retailers (especially anchor tenants, i.e. MAPI ) will be able to secure a better rental rate in 2H20, or even up to next year. In the early months of re-openings, retailers also continuously negotiate rental discounts to the landlords as traffic remains soft (we think likely up to 50% or even more).

Maintain Neutral with ACES as our top pick

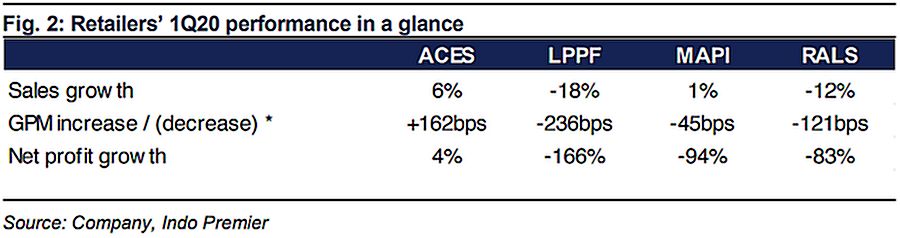

We believe SSSG and GPM shall bottom in 2Q20. In sum, we have estimated an aggregate earnings decline of -47% yoy in FY20F. On a more positive note, traffic is improving although gradually, while cost cutting may continue to partially alleviate burdens. While weakness in FY20F shall be partially priced in, traffic recovery in 2021F may be slow and gradual. We maintain our Neutral call on the sector; ACES is our top pick thanks to its nature as home improvement retailer and excellent product mix.

Sumber : IPS

powered by: IPOTNEWS.COM