- Initiation : The Worst IS be behind us / BUY TP8000 (20% Potential UPSIDE)

- : 3Q19 in Line - Excellence Operations

- : Hyundai Deal is DONE

- : Solid Fundamental / undemanding valuation

.

: The worst is behind us

Download complete report

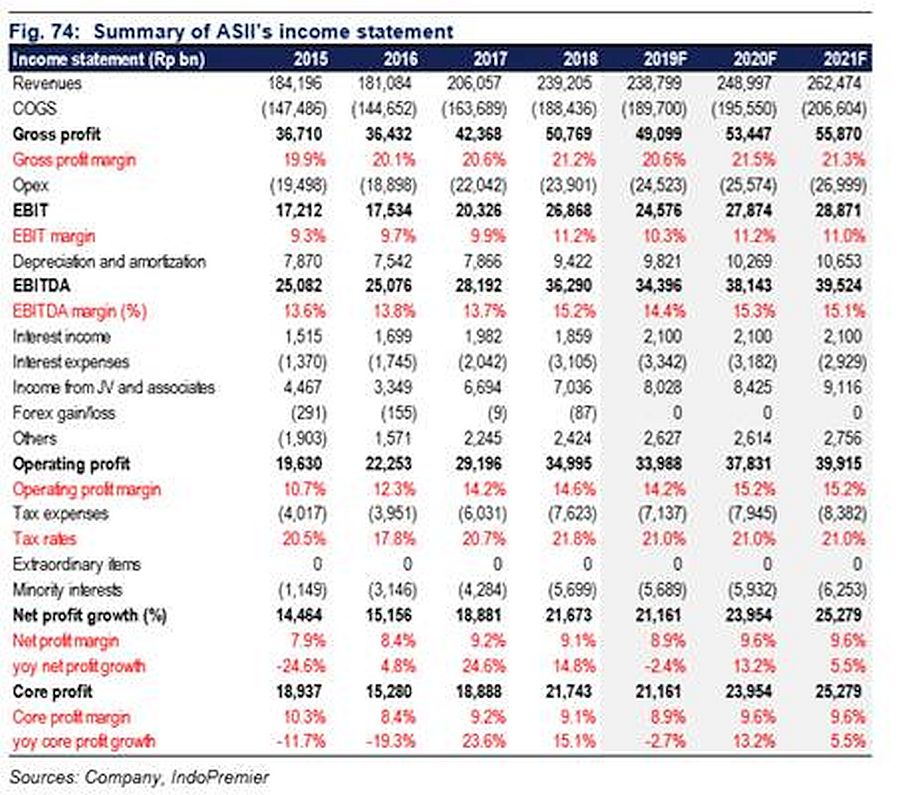

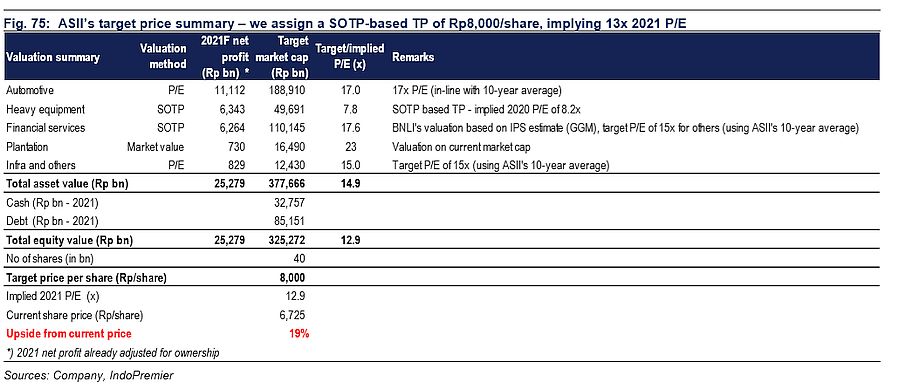

Tim Handerson, our Auto Analyst, initiated with BUY Rating with TP8000 (+20% POTENTIAL UPSIDE)

He reckons 4W division will perform better 2020/2021 (vs 2019 in which was a political year).

Economy Recovery + Better Commodity px + Normalizing investment + New launches will be in favor of

We expect 's to see stronger 4W volume growth than the industry: -8% in 2019, +3% yoy in 2020, and +7% yoy in 2021 as we expect it strong brand equity and (potential) new models, coupled with waning competition, to result in a robust market share.

At current valuation has clearly not priced-in any recovery. Initiate with a Buy rating.

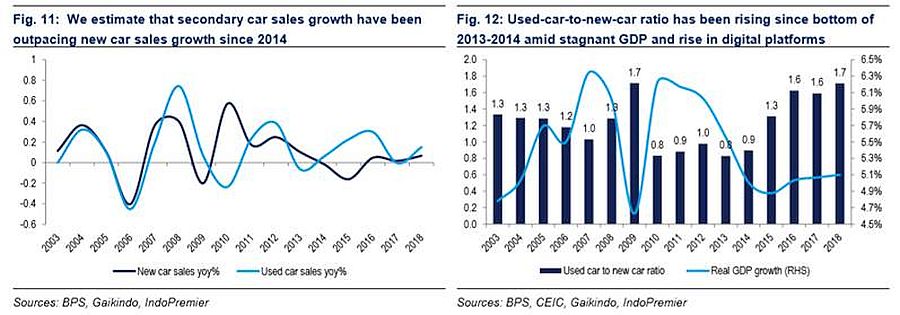

Another thing is worth to highlight - Competition from used car intensified during periods of weak economy

Yet, preference to buy used cars might reverse as the economy recovers. Our checks suggest that a Rp20-30mn difference between used and new car prices would still encourage buyers to opt for new cars.

Risks from regulation changes, a shift towards EV? It will take time / affordability is the challenge for Indo Market at the moment

We think that EV's traction in Indonesia still might take quite some time as price would remain the key issue. Even in the United States (2nd largest consumer of EVs), price of full EVs are still twice as high as the hybrid/internal combustion based vehicles. Furthermore, we think the lack of assurance on resale value and infrastructure (i.e. charging stations, affordable battery replacement, etc) might further deter traction in the initial years of its introduction.

's valuation relative to JCI - We believe that the expected recovery in 2020-21 has clearly not been priced in at the current valuation.

: 3Q19 result in-line Ebitda and excellent operating performance

Download complete report

Stock Split 1:5, effective TODAY

- 9M19 Ebitda grew in line (+8.2% YoY), driven by tenancies addition of 11.7% YoY. Slight miss on profit due to higher than expected tax.

- Strong tenancy addition increased the overall tenancy ratio to 1.8x. Most of the new tenants added in 3Q19 came from Hutchison 3 Indonesia.

- Gross tenant addition of 2,578 in 9M19 is ahead of FY19 target of 3,000 tenant addition (86% achieved). Maintain Buy.

.

has secured the Hyundai deal; more to come - dividend yield will still be attractive

has secured its land sales to Hyundai (77ha) with around Rp1.7-1.8mn ASP; this shall translate to Rp1.3-1.4tr of additional marketing sales.

Note that its 9M achievement of marketing sales already stood at Rp1.6tr - this shall brought total presales for this year for c.Rp3tr (vs. its Rp1.2tr target). Additionally, they are currently also in talk with another auto maker (motorcycle) for potentially another 50-60ha of land sales (expected to be early next year).

Few other details:

- On top of the potential 5060ha land sales to the auto maker, still has potentially another 100ha of land sales next year (60ha from 2 ecommerce companies another 40ha from two other consumer companies).

- With Rp770bn profit in 9M, and 20ha unrecognized backlog (assuming Rp1.8mn ASP translating to Rp360bn additional revenue and Rp200bn of profit), we expect it will be able to book Rp1tr profit (vs. Rp810bn consensus) for 2019 without Hyundai sales (16x FY19 PE). If we include Hyundai sale, total profit will be around Rp1.71.8tr (9x FY19 PE).

- With ample cash balance of Rp1.1tr as of 9M and potential additional Rp1tr cash addition (from Hyundai and backlog), cash balance will be ballooned to Rp2.1tr and if we conservatively assume 90% payout (last year the payout was 204%) its dividend yield will be 11.8%.

- Our profit and cash assumption still not taking into account potential sales to the automaker or any other potential buyers.

.

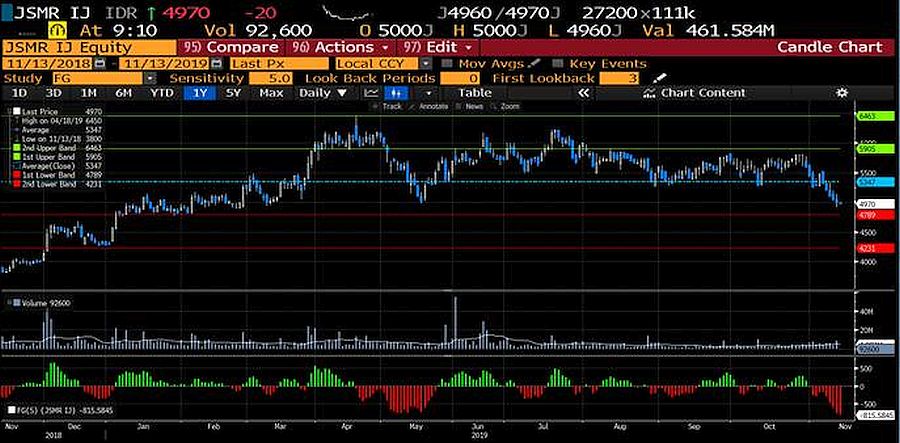

BUY - Solid Fundamental / everything is in-tact

- We reckon there is no significant risk that might jeopardize 's financial performance 2019/2020

- Risk of tariff cap? It is there but hard to justify / we saw no precedent yet.

- Valuation is very undemanding / miss-priced asset we reckon

.

Snippets

reported to have secured 77ha land sale to Hyundai

Kontan reported that is expected to finalize the 77ha industrial land sale to Hyundai Motors Group by end of Nov19. On top of that, also was reported to have secured a sales and purchase agreement with Honda for 60ha of industrial land sale. ' management has yet to confirm these reports. (Kontan)

to participate in bidding for 's towers

's management cited that they will be participating in the bidding for 3.3k towers owned by . The management is confident that they still have room for the acquisition. As of today, the 1:5 stock split will also be effective. (Investor Daily)

obtains US$750mn of borrowings

has just secured US$750mn of new borrowing facilities, with option to increase it to US$1bn, which shall be used for both expansion and refinancing. The facility is split into two tranches: Series A (US$375mn with tenor of 3.5 years) and Series B (US$375mn with tenor of 5 years). CTBC Bank Co is the mandated lead arranger, while the other participants for the syndication include MUFG Bank Ltd, Sumitmo Mitsui, and UOB. (Investor Daily)

targets 10% growth in consumer loans in 2020

targets for 8-10% consumer loan gorwth in 2020, higher than 5% projected for 2019. For mortgages, will focus on smaller size loans to accommodate the current demand trend, as it has noticed an increase in loan application with size

Indomobil Group distributes Kia

PT Kreta Indo Artha, a subsidiary of Indomobil Group, has officially taken distributorship of Kia cars in Indonesia. Since its appointment as the brand agent (APM) on May19, it has opened 24 sales/aftersales network points. Going forward, it plans to expand its network to outside of Greater Jakarta as well, including Surabaya, Malang, Medana, Palembang, and other major cities. (Bisnis Indonesia)

Ciputra Residence aims for Rp750bn of marketing sales in 2019

Ciputra Residence, subsidiary of , expects to be able to meet its FY19 presales target of Rp750bn. As of Sep19, Ciputra Residence has achieved 70% of its target. Citra Maja Raya will be the main driver - currently development has entered the second phase with a total development area of 500ha and 7,000 units of houses with price of below Rp400mn/unit (Bisnis Indonesia)

Sumber : IPS

powered by: IPOTNEWS.COM