Company Update / Toll Road / IJ /Click here for full PDF version

Author : Timothy Handerson

- Mar21 average daily revenues were only -4% vs. pre-Covid. Mudikn restriction is net positive as it will limit downside to overall traffic.

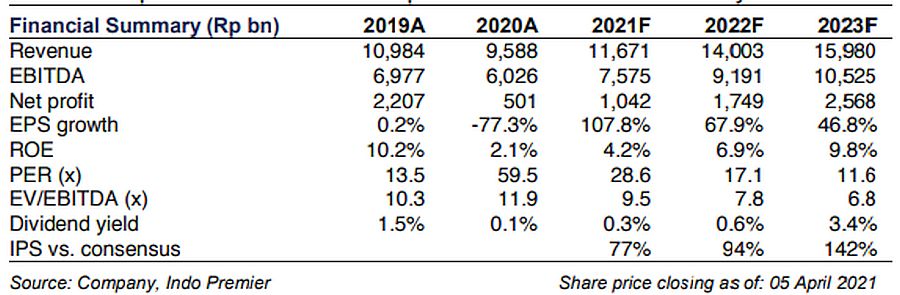

- We estimate EBITDA CAGR of +20% in FY20-23F on the back of volumen recovery and increasing revenue proportion from new concessions.

- It expects to finalize divestment on some of its toll concessions this year,n though further details have yet to be confirmed. Maintain Buy.

Continuous traffic recovery, in-line with our FY21F base case

Mar21 average daily revenues were down 4% vs. pre-Covid level, as traffic volume has recovered post PPKM implementation in early Jan. Concurrently, we believe that Mudik restriction shall be net positive for as 1) limited volume downside (traffic during Lebaran season is usually<5% higher vs. rest of the year), and 2) better handling of Covid cases, which shall result in better traffic post-holiday as previous events of unrestricted holidays (Aug20, Oct20, and Jan21) resulted in c.10% decline in average daily revenues for the next 2-4 weeks (amid tighter PSBB implementation post holiday). At this point, we believe that our FY21F volume growth assumption of +15% yoy remains achievable.

Robust EBITDA growth outlook going forward

The proportion of toll revenues from subsidiary toll roads (non-majority toll road) rose to 32% in FY20 vs. 29% in FY19, with management aiming for 50:50 split between parent and subsidiary revenues (which shall be achievable as early as FY24F). As such, we pencil-in EBITDA growth of 20% FY20-23F CAGR driven by both revenue growth (+17% FY20-23F CAGR on the back of volume recovery and tariff adjustments) and better margin of 64- 66% in FY21-23F vs. 62% in FY20, in-line with higher revenue contribution of new concessions (which have higher EBITDA margins of 75-85% vs. old concession of 60-65%).

Greater focus on asset recycling is a positive strategy

indicated for potential divestments on some of its concessions to be finalized this year, though further details have yet to be confirmed. Based on our preliminary assessment, we expect Rp2.6-3.4tr of proceeds and Rp700bn-1.4tr of potential gains assuming partial divestments on 5 concessions which has majority ownership (Fig 5 - further details in our previous report here ), representing 30-50% upside to our FY21-22F net profit (assuming divestment is partially done in FY21F and FY22F).

Maintain Buy

We lower our EPS forecasts by 21-26% largely due to a higher interest expenses assumption, though maintain Buy with an unchanged DCF-based TP ( WACC : 10.5%) on the back of robust EBITDA growth and upside from acceleration of asset recycling starting this year. now trades at 9x FY21F EV/EBITDA (vs. 10Y average of 11x). Main risk is delay to its divestment plan and worse-than-expected traffic volume recovery.

Sumber : IPS

powered by: IPOTNEWS.COM