Key takeaways from BI Board meeting:

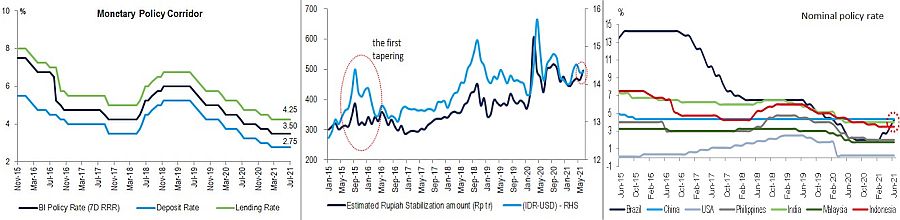

- Bank Indonesia sees global economic continue to recover, but sees more financial sector uncertainty as the Fed's monetary policy has caused flight to quality. BI said that Indonesia current account deficit will continue to be low at 0.6% - 4% of GDP (previously at 1% - 2% of GDP) and the Rupiah to be stable in 202 BI said that recent Rupiah appreciation is caused by capital inflows and will continue to let market mechanism works.

- On domestic economy, Bank Indonesia sees Indonesia economy recovered quite well in 1H21, but 2H21 will be lower due to the emergency PPKM . BI revised further its economic growth forecast to be at 3.5% to 4.3% (previous expectation at 4.1% - 5.1%, initially at 4.8% - 5.8%). In the meantime, BI said inflation in 2021 would be on BI's target at 2.0% - 4.0% and committed to keep inflation figure to be manageable. Bank Indonesia stated its commitment to finance the state budget that comply with SKB 1 (April 2020). In 2021 (as of 19 Jul), BI had Bought Rp124.1tr worth of SUN in primary market (Rp75.5tr via green shoe).

- Bank Indonesia sees the banking liquidity situation to be very ample, with very high LCR indicator at roughly 33% mtd. BI is committed to channel the abundant liquidity in the banking system. The credit growth rebounded to grew by +0.6% yoy in Jun21 (-1.3% in May21) and stated the credit growth target at 4% - 6% in 2021 is achievable (6%-8% yoy target for deposit growth this year).

Our take:

We believe the policy rate at 3.5% to be the optimal level and shall be maintained until year-end. We see the potential of sooner-than-expected monetary policy normalization in the US may put pressure to the Rupiah, but unlikely trigger BI rate hike this year as economic recovery still challenging. Nevertheless, with the current ample forex reserves, the pressure to Rupiah will likely be manageable an temporary, in our view. (Indo Premier Research)

Sumber : IPS