Yesterday we published a note highlighting potential adverse changes in KUR scheme (2 days ago we also published a report highlighting intervention risk ), while indeed it spooked market amid interventionist/populist stance of the government (following potential cut in the gas price) we think the impact to BRI share price was overblown (-7% in 2 days). Based on our calculation (under full blown worst case scenario of lower KUR rate and extreme cannibalization) impact to earnings from those changes only mere 2-3%.

Hence, we believe its worth to stick to fundamentals despite all the adverse noises ( history suggests the noises were only temporary - at least for the banking sector ). Our picks stay with and

Link to our note: Impact on KUR changes Nov19

Few highlights from our note:

The media recently reported that government plans to reduce KUR (the subsidized micro loan program) to 6% from 7% currently, though there no details yet on subsidy rate. At the same time, the maximum ticket size for the micro KUR will be potentially increased to Rp50mn from Rp25mn currently. We won't know the full details on KUR rate/subsidy rate/insurance premium by late Nov/early Dec

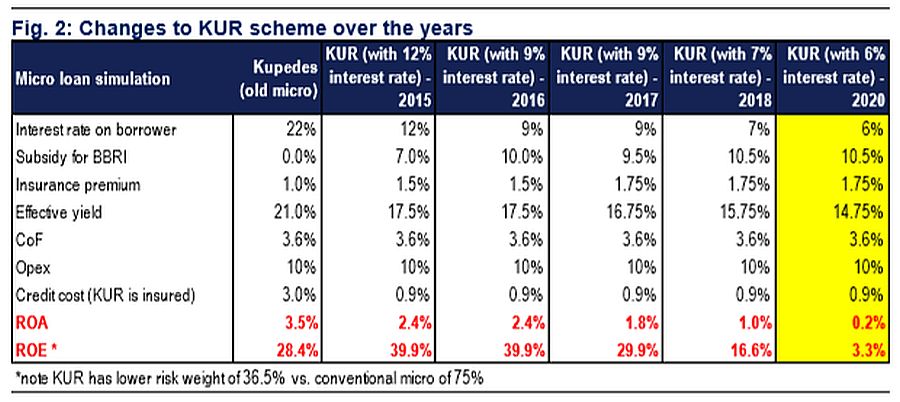

This is not the first time that government cut KUR rate, previously KUR rate has been reduced from 12% in 2015 to 9% in 2016-17 and 7% in 2018. Despite 500bp cut in the KUR rate, the subsidy for micro KUR only increased by 350bp. Assuming flat subsidy this time around, we estimate KUR's ROA/ROE will drop to 0.2%/3% from 1.0%/16% (Kupedes ROA/ROE at 3.5%/28%) - making it relatively unprofitable to disburse.

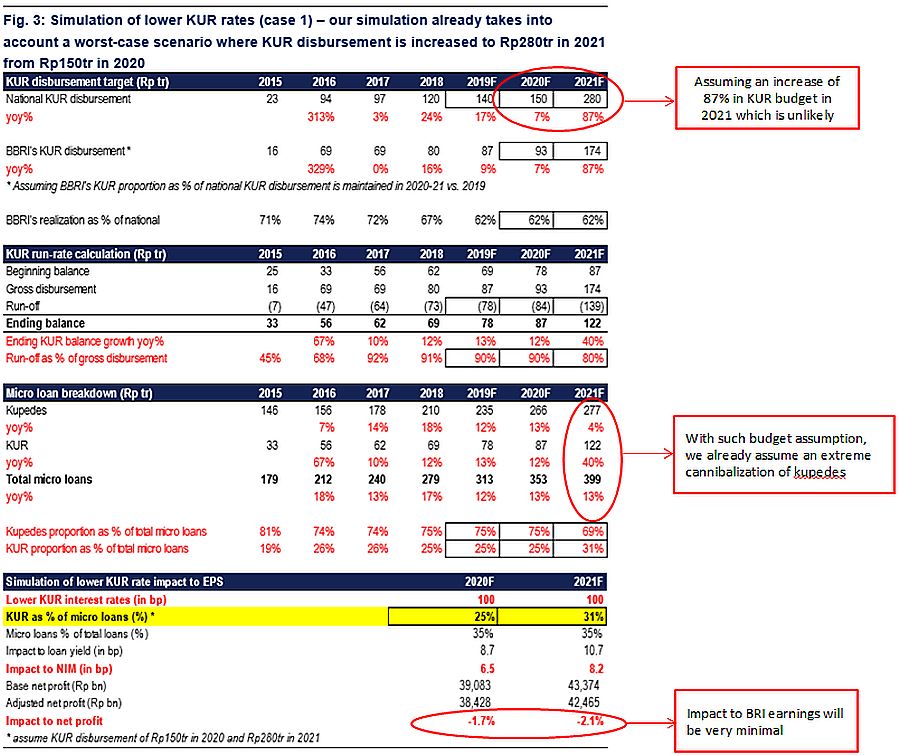

Increase in maximum KUR's micro loan size to Rp50mn from Rp25mn may cannibalize Kupedes amid similar loan size (at Rp51mn as of 9M19 vs. KUR's Rp13mn). However, the impact based on our estimates was way more benign than what people expect - based on lower rate, Rp280tr KUR's budget in 2021 (vs. Rp150tr in 2020) and thus an implied KUR growth of 40% vs. Kupedes's 4% (already taking into account cannibalization), the overall impact to BRI's 2021 NIM and EPS is only 8bp and 2%, respectively - this was largely due KUR's short tenor and thus higher run-off rate (80-90% p.a.) - refer to figure 3 below.

We also did another worse scenario, when we assume 100% 's take-up rate against national target (refer to figure 4 in our note), EPS impact also remains minimal at 3%.

We also did another worse scenario, when we assume 100% 's take-up rate against national target (refer to figure 4 in our note), EPS impact also remains minimal at 3%.

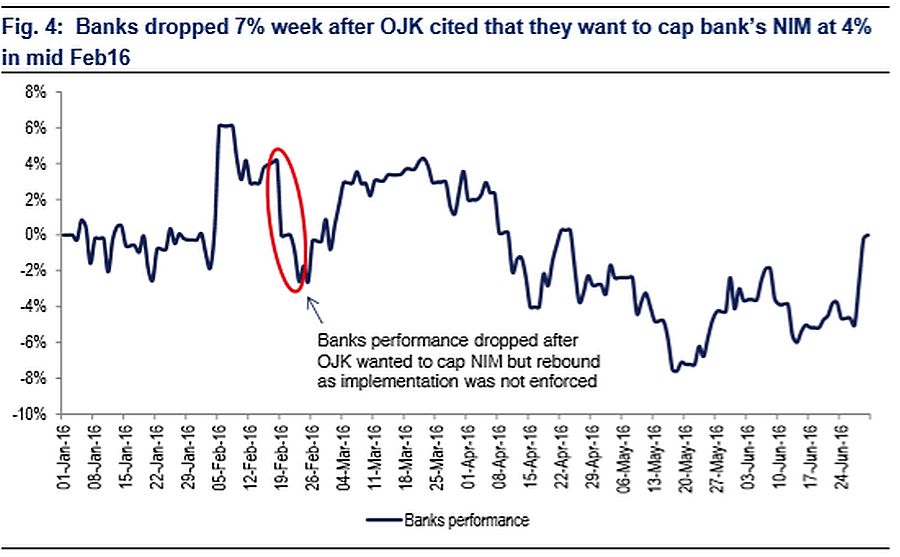

We think its best to stick to fundamental despite adverse news flow. History suggests interventionist policy on banks were more a moral suasion instead of enforcement (early in 2016, OJK plans to cap bank's NIM)

Sumber : IPS