Company Update / Banks / IJ / Click here for full PDF version

- Restructured loans have been on the declining trend in the last 3 months, the only bank that managed such feat.

- Covid restructuring quality has been stellar amid minimal re-restructuring after 6 months grace period. This in-line with NIM improvement.

- Withupcoming integration of Pegadaian and PNM, we think is poised to re-rate further. Upgrade our EPS and TP to Rp5,600.

Covid restructuring loan was on the declining trend for 3 straight months

was the only bank that able to post 3 straight months of decline in its overall Covid restructuring balance; overall balance now stood at Rp187tr in Dec20 (20% of loan) vs. peak of Rp194tr in Sep20 (21% of loan). Our conversation with the bank suggested that the decline was attributed to gradual improvement onits MSME portfolio and is expected to continue in 2021. This was consistent with our thesis that tight PSBB in Jakarta (especially for malls and restaurants) will not impact BRI's portfolio.

Asset quality for Covid restructuring has been surprisingly robust; this may lead to better CoC in FY21-22

To our surprise, the quality of Covid restructuring portfolio has been robust; with the proportion of re-restructuring (2x Covid restructuring) has been only at c.Rp11tr in Nov20/6% of total loan.Note that the re-restructuring started in Sep onwards which was after the end of grace period (majority of MSME loan got 6 months grace period), as such the Nov data has captured the Mar-May restructuring (85% of total Covid restructuring). has also implemented a very rigid re-restructuring criterion i.e. maximum of 2x restruc, there will be no full payment holiday (maximum in principal holiday). The stellar restructuring is also in-line with its NIM improvement with Nov20 NIM reaching 6.4% vs. bottom of 3.2% in Apr20 and pre-Covid level of 6.8-7.2% in Jan-Mar20.

Upcoming integration with Pegadaian and PNM is also a boon

Upcoming MnA with Pegadaian and PNM shall add c.10% to its FY21 earnings and +8bp/-38bp to ROA/ROE. Note that this hasn't taken into account the potential synergy ( please refer to our previous note ).

Upgrade our EPS and TP; maintain Buy

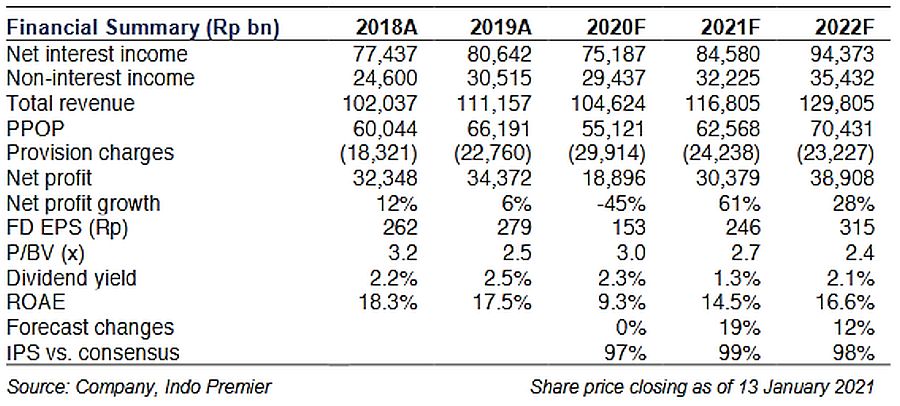

We upgrade our FY21-22 EPS by 12-19% on the back of lower CoC assumption and also our TP to Rp5,600now implying 2.7x FY21 P/BV(at +0.5 over its LT average). BRI was the major outperformer (+17% against SOE bank peers in the past one year) and will continuein FY21, we believe.

Sumber : IPS