MacroInsight / Click here for full PDF version

Author(s):Luthfi Ridho,Desty Fauziah

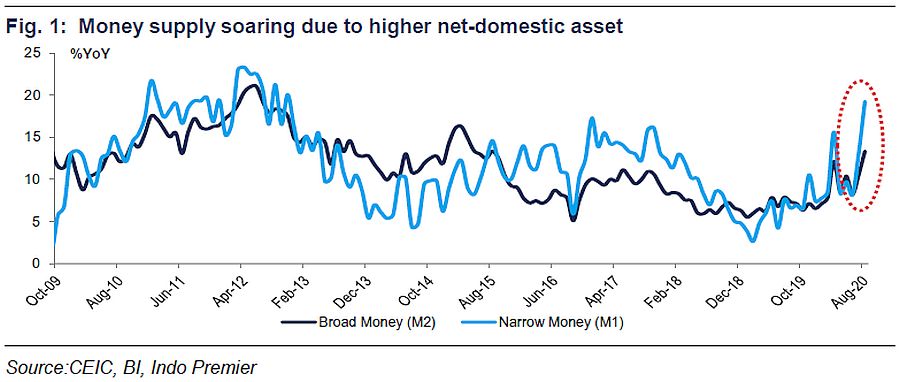

- M2 grew higher by 13.3% yoy in Aug20 (10.5% yoy in Jul20) largely due to higher NDA at 13.2% yoy (+8.2% yoy in Jul20), while NFA grew less.

- Private credit growth declined to 0.6% yoy in Aug20 (+1.0% yoy in Jul20) mostly from contraction in working capital loan at -1.7% yoy.

- Liquidity distribution to the real sector via accommodative monetary policy is imperative to speed-up the economic recovery process.

Higher M2 from pick-up in NDA

Money supply (M2) grew higher by 13.3% yoy in Aug20 (10.5% yoy in Jul20), largely due to higher net-domestic asset (NDA) growth at 13.2% yoy in Aug20 (+8.2% yoy in Jul20). The higher growth in NDA was coming from expanding central government financial operation, indicated by higher net-claim by the government growth at 65.1% yoy in Aug20 (+40.8% yoy in Jul20). Meanwhile net-foreign asset (NFA) grew slower by 13.8% yoy in Aug20 (+17.6% yoy in Jul), due to outflows in both bonds and equity by -US$0.26bn and -US$0.58bn (+US$0.61bn and US$-0.27bn in Jul).

Drop in private credit, while third-party-deposit continued to rise

Private credit remained soft at 0.6% yoy in Aug20 (+1.0% yoy in Jul20, +5.7% yoy in Jan20) due to contraction in working capital loan at 1.7% yoy in Aug20 (-1.7% yoy in Jul20). Biggest contraction happened in working capital loan in electricity & gas sector and construction sector at 8.8% and 7.7% yoy (+6.6% and -6.2% yoy in Jul20). In addition, investment and consumption loan grew less by 4.0% and 1.1% yoy in Aug20 (+5.2% and 1.5% yoy respectively in Jul20). In the meantime, the third-party deposit grew higher by 10.9% yoy in Aug20 (+7.7% yoy in Jul20). In terms of BUKU (size of the banks) category, deposits in BUKU IV banks grew the highest at 15.1% yoy in Aug20 (+12.7% yoy in Jul20).

More accommodative monetary policy is needed

The open market operation reached an all-time high position at Rp663tr in Aug (around Rp420tr in 1Q20), which suggests an abundant liquidity in the financial sector. We are on the view that the ample liquidity in the financial sector needs to be distributed to the real sector to fasten the economic recovery. However, we also believe accommodative monetary policy will play an important role to address this and hence, we expect a potential 50bp policy rate cut from the central bank in the 4Q20 in order to stimulate more private credit growth. The accommodative monetary policy shall also improve the monetary transmission mechanism, while also reducing the default rate during economic downturn.

Sumber : IPS

powered by: IPOTNEWS.COM