Company Update / Coal / IJ / Click here for full PDF version

Author(s) : E rindra Krisnawan ; Reggie Parengkuan

- 1Q23 earnings was a strong beat (at 36/41% of ours/consensus FY23 estimates) on higher-than-expected sales volume and ASP.

- Nickel business' earnings rose 24% yoy in 1Q23, but missed our expectations due to lower nickel ASP and higher cost.

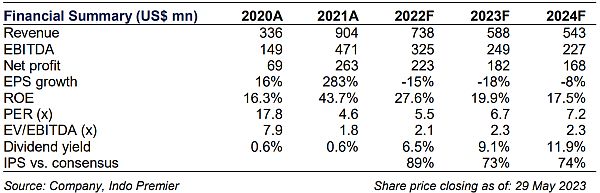

- We cut our FY23/24/25F earnings by 22/36/38% and cut SOTP -based TP to Rp2,000 on lower nickel earnings; reiterate Buy on attractive valuation.

1Q23 results beat from strong coal price and volumes

Despite lower coal price in 1Q23, 's net profit improved to US$103mn (+60% qoq/+64% yoy), a beat to ours/consensus estimates (at 34/41 of FY23 forecast). The stellar performance was mainly attributed to higher sales volume growth coupled with above-expected ASP. Income from associates (nickel business) improved to US$15mn (+39% qoq/+24% yoy), also driven by higher production, though margin was below our expectations. Nickel Industries' (NIC) RKEF cash margin declined 19% qoq but was partly offset by higher volume from Oracle smelter ramp up.

Soft ASP was more than offset by robust sales volume and lower cost

sales/production volume of 1.8/1.7Mt in 1Q23 (+64/6% qoq, +100/70% yoy) was a strong beat at 33/29% of our FY23 estimates. Management indicated that sales volume was exceptionally strong in 1Q23 as there were some delayed shipments in 4Q22. ASP declined to US$163/t in 1Q23 (-9% qoq/-2% yoy), but was still well above our FY23 forecast of US$108/t. Meanwhile, cash cost also fell to US$76/t (-16% qoq/+6% yoy), mainly attributed to lower SR of 7.5x (vs. 9.3/10.2 in 4Q22/1Q22), much lower than our FY23 estimates of 10.6x. Despite this, management guided for SR target of 10x as lower SR in 1Q23 was attributed to maintenance in KUP mine.

Cut FY23/24/25F earnings to reflect higher cost

We adjust cut our FY23/24/25F earnings estimate by 22/36/38% to reflect the following: 1) higher coal ASP of US$120/t in FY23F (vs.US$108/t previously). 2) higher cash cost of US$76/63/59 per tonne in FY23/24/25F (vs. US$51/47/44 previously). 3) higher royalty rate of 18% from 16% previously. 4) lower income from nickel associates on lower margin assumptions.

Maintain Buy at a lower SOTP -based TP of Rp2,000

We cut our SOTP -based TP to Rp2,000, mainly reflecting lower coal cash margin. We maintain our Buy rating on still attractive 3.8x FY23F EV/EBITDA (36% discount to 10-year mean). Key risks are lower coal and nickel prices.

Sumber : IPS

powered by: IPOTNEWS.COM