MacroInsight / Click here for full PDF version

Author(s): Luthfi Ridho

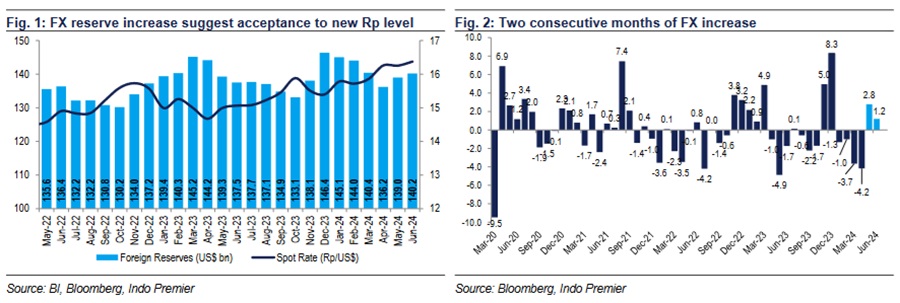

- FX reserves increased further by US$1.2bn to US$140.2bn in Jun24 (vs. US$139bn in May24) mainly from global bonds issuance at c.US$2.3bn.

- Rupiah depreciated further at -1.6% mom/-9.3% yoy/-5.3% YTD to Rp16.4k/US$ in Jun24, from +0.3% mom/-8.2% yoy/-3.6% YTD in May24

- We expect Rupiah to be at c.Rp16k/US$ avg in FY24, with the assumption of another 25bp increase in the BI rate to 6.5% by year-end.

FX reserve increase suggests a new equilibrium for Rupiah

FX reserve rose further by US$1.2bn to US$140.2bn in Jun24 (US$139/136.2bn in May/Apr24) amid global sharia bonds issuance of US$2.35bn and international trade tax at c.US$1.85bn. Our estimation of the Rupiah sterilization during Jun24 was at around c.US$3bn. In addition, the FX reserve position was equivalent to 6.3 months of imports or 6.1 months of imports and government debt payments. We are on the view that the further increase in reserves in Jun24 was suggesting a new equilibrium for Rupiah at above Rp16k/US$.

DHE inflows improves but have neutral impact on Rupiah

The inflows of DHE policy fund improved further to US$0.7bn in Jun24 from US$0.63/0.4bn in May/Apr24. By far, the impact of the DHE policy fund to Rupiah proven to be broadly neutral (see fig.5). Since the first introduction in Aug23, the DHE fund dynamics seems to be insignificant to influence both Rupiah movement and onshore US$ supply.

Rupiah likely to average higher in FY24

With the increase in reserves, we are on the view that current Rupiah level of around Rp16k/US$ may be the new equilibrium level. The increase in reserves was pointing to minimum Rupiah-intervention, just to keep Rupiah from depreciating too much (instead of bringing stronger Rupiah). Therefore, we see the Rupiah to be depreciating to Rp16k/US$ average in FY24 from Rp15.2k/US$ in FY23. Nevertheless, we think the policy rate may still be increased by 25bp to put more stability to the Rupiah by year-end should there be any unexpected global volatility.

Sumber : IPS