MacroInsight / Click link to PDF

Author :Luthfi Ridho

- Trade surplus remained high at US$2.4bn in Jun24 (+US$2.9bn in May24), but lower than consensus/ours at c.US$2.9/3.2bn.

- On quarterly basis, the surplus is higher at US$8.0bn in 2Q24 (US$7.4bn in 1Q24) and shall be positive for 2Q24 GDP/current account.

- We see GDP growth to grow slower at c.4.9% in 2Q24 (+5.0% in 1Q24), as weaker domestic demand may offset higher trade surplus.

Another month of trade surplus albeit lower than consensus

Exports grew slower while imports rebounded to +1.2%/+7.6% yoy in Jun24 (+2.9%/-8.8% yoy in May24). Trade surplus recorded at US$2.4bn (consensus at +US$2.9bn). The slower export growth came from both oil & gas and non-oil & gas at -2.4%/+1.4% yoy (+8.4%/+2.5% yoy in May24), while higher growth in imports comes from both Oil & gas and non-oil & gas at +47.1%/+1.7% yoy (-12.3%/-8.2% yoy in May24).

Higher trade surplus on qoq basis

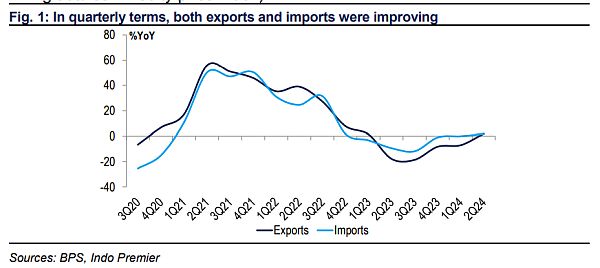

On quarterly terms, trade surplus recorded higher at US$8.0bn in 2Q24 (from US$7.4bn in 1Q24). This should be positive for 2Q24 GDP and current account deficit (our estimates at +4.9% yoy and -0.6% of GDP). The rebound in both exports and imports in 2Q24 at +1.9%/+1.8% yoy (-7.1%/-0.1% yoy in 1Q24), shall have a positive impact to domestic economic activity in 3Q and 4Q24.

Iron and steel were the bright spot in 2Q24

Iron & steel export were the bright spot with a rebound of +1.5% yoy in 2Q24 (-6.9% yoy in 1Q24), as average base metal prices were increasing by +4.6% yoy (+3.5% yoy in average in 1Q24). Furthermore, all major commodities recorded lesser contraction, such as coal/CPO at -12.8%/-3.8% yoy in 2Q24 (-24.2%/-15.2% yoy in 1Q24). We see the improvement was coming mostly from better price at -10.3%/+1.3% yoy in 2Q24 (-58.4%/-10.2% yoy in 1Q24), respectively for coal and CPO.

Expect slower GDP growth in 2Q24 from domestic demand

We see the trade surplus to be positive for 2Q24 GDP growth especially from the external trade (we see domestic demand to be challenging). However, we are on the view that GDP growth will decelerate to c.+4.9% yoy in 2Q24 (+5.1% in 1Q24), since the weaker domestic demand (no festive events during the quarter) may offset the higher trade surplus. Lastly, we see elevated trade surplus will likely continue as the global commodity prices are consistently improving at +8.6%/+7.4%/-0.2% yoy in Jun/May/Apr24 (source: IMF global commodity price index).

Sumber : IPS