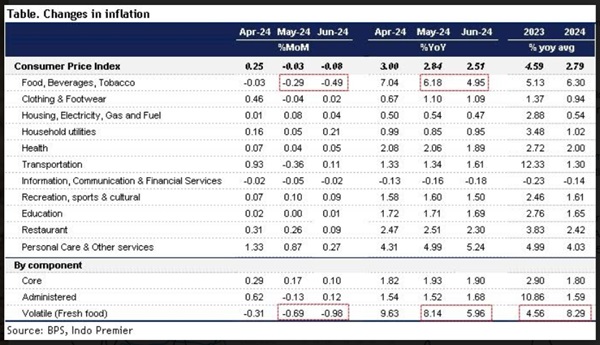

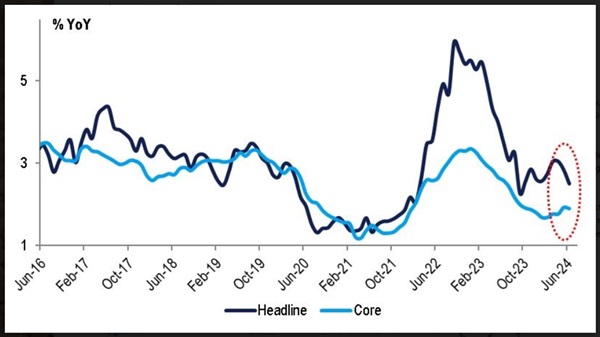

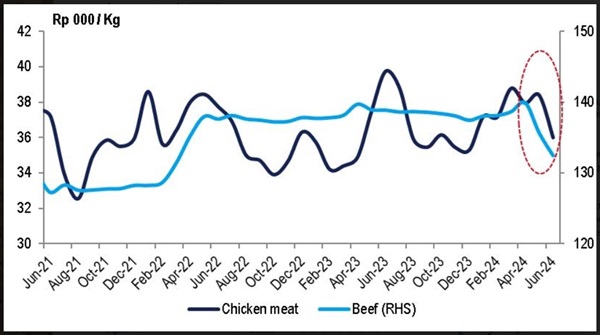

Headline CPI recorded further deflation at -0.08% mom/+2.51% yoy in Jun24(-0.03% mom/+2.84% yoy in May24), lower than ours and consensus at roughly +0.1%mom/+2.7% yoy. The moderation in inflation mainly comes from FnB and Infocomm at -0.49% /-0.02% mom or +4.95%/-0.18% yoy. In our price tracker, the top3 food that have the most monthly price decline were chicken meat, beef and onion.

Similarly, the core inflation continues to decline at +0.1mom/+1.9yoy in Jun24 (+0.17mom/+1.93yoy in May24). The monthly decline comes from health, recreation, education and restaurant, but offset by jewelry made of gold at +0.25% contribution to the headline inflation. Global gold prices were increasing at +20%/+18%/16% yoy in Jun/May/Apr24.

We revise down our inflation expectation to c.+2.7% in FY24 (previously c.+3.59%, +2.61% yoy in FY23) due to lower-than-expected economic activity. Overall, we are on the view that household purchasing power is still soft, pointing to benign inflation until year-end. Accordingly, we think the BI rate will be held unchanged in July meeting.However, we believe uncertainty in Rupiah volatility may prompt BI to put another 25bp rate hike to 6.5% in FY24.

Sumber : IPS