Company Update / Banks / IJ / Click here for full PDF version

Author(s): Jovent Muliadi ;Anthony

- We recently hosted a meeting with BRI management to discuss its 7M results and overall asset quality outlook.

- We found that the spike in Jul24 CoC was attributed to management' conservative stance and expect its CoC to normalize from Aug onwards.

- We continue to like alongside especially that it has the highest multiple's sensitivity during rate cut cycle.

7M24 results: a bad month but shall not be extrapolated further

bank-only profit of Rp31.4tr in 7M24 (+2% yoy/-50% mom) came as a negative surprise.This was attributed to spike in opex (+45% mom) from higher personnel expenses for additional micro loan officers, one-off leave allowance (c.Rp250-300bn), and one-off provision for non-cash loan (NCL) amounting Rp1.6tr which will be reversed in the coming months. At the same time, provision for loan rose by +174% mom which translate to CoC of 3.9% in Jul24 (vs. 1.4% in Jun24) - 7M24 CoC to 3.4% (+6bp vs. 1H24). Loan grew by +9% yoy (flat mom) slower than deposits of +13% (flat mom).

Overall asset quality was relatively stable mom; higher provision was a ramp-up for restructured micro portfolio

During our discussion, it was highlighted that overall micro NPL stood at 3.04% in Jul24 vs. 2.95% in Jun24 while SML stood at 6.79% in Jul24 vs. 6.87% in Jun24; both are relatively stable which begs the question why sudden jump in the provision on mom basis. There were two main reasons for this:1) a seasonal pattern post reporting month(in the past 3 quarters CoC always spiked one month after quarterly result i.e. Apr/Jan24 CoC at 3.5/2.2% vs. Mar24/Dec23 CoC at 2.5/0.5%) and2) ramp-up on provision for restructured portfolio to 27% in Jul24 from 19% in Jun24- note that it plans to restructure Rp15-20tr of micro portfolio in FY24 (Jul24 at Rp13tr) which has been incorporated into 3% CoC guidance with assumption of 25-30% default rate, hence the ramp-up in coverage to 27% in Jul24.

We expect provision is expected to trend down in the coming months; management conservatives was underappreciated

With additional Rp2-7tr of restructured portfolio and 30% coverage, overall provision of Rp600bn-2.1tr provision for the remainder of the year is manageable in our view.At the same time, it was highlighted that CoC without management overlay was at 3.1% in 7M24 (vs. 3.4% with overlayto ramp-up the coverage on restructured portfolio); this was a reflection of management conservatives which was mistakenly perceived by the market as the sign of worsening asset quality.Management corroborated our view and reiterated that both restructured portfolio and CoC guidance of 3% remains unchanged even after taking into account the QTD data.

Maintaining as our top pick alongside

While it is easier for market to digest our call on , we think the weakness in is a good entry point especially with it has the highest multiple's sensitivity during rate cut cycle and better CoC outlook. Back last year, when we were bullish on 's multiple re-rating, investors were also very skeptical on its ability to deliver sustainable growth in both loan and savings (link to our last year's note); on the other hand, consensus were so bullish on /BBNI. As such, given the worse scepticism for , we think the upside is bigger if our thesis is proven to be correct.

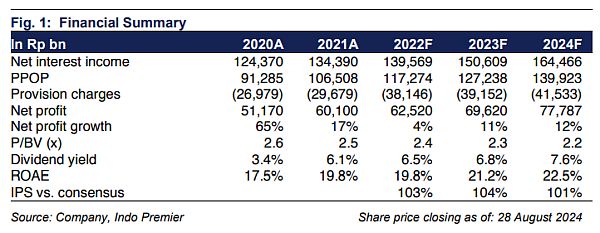

Sumber : IPS