Company Update / Banks / IJ / Click here for full PDF version

Author(s): Jovent Muliadi ;Axel Azriel

- Government plans to relax 2026 KUR criteria: 1) no cap on the cycle (previously up to 4x) & 2) no step up interest (up to 9% previously).

- While in hindsight this may look negative for Kupedes (cannibalization), we think this is positive for asset quality and RoRWA/ROE.

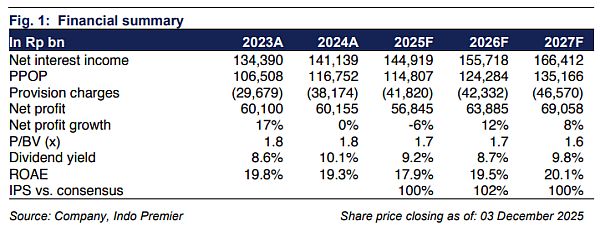

- We maintain Buy for as we think that valuation of 1.7x/8.7x FY26F P/B and P/E shall represent the trough for the stock.

KUR relaxation for 2026

According to Government press release, there will be some relaxation on 2026 KUR: 1) no cap on the cycle (previously KUR is up to 4x cycle for productive and 2x cycle for non-productive i.e. trading) and 2) no step up interest (flat at 6%) - previously KUR interest rate will go up to 7/8/9% for 2nd/3rd/4thcycle respectively. However, we are currently unclear whether this relaxation shall be applicable to all KUR or only for productive KUR (60% of total KUR).

The pessimist will argue that this shall made Kupedes irrelevant

The main concern from this relaxation is that there will be no KUR graduation going forward, which also implies that Kupedes will only be disbursed when the KUR quota runs out. Looking back in 2023, when there is a delay in KUR disbursement (starting in 3Q23) and tightening (cap on max 4 cycle along with step up interest), there was a drop in 2mn KUR customers (to 8.8mn in 2023 from 10.9mn in 2022) and was migrated to Kupedes. This was the start of the current BRI's asset quality problem, in our view.As such,we firmly believe that KUR and Kupedes micro customers are inherently different in repayment capability; and as such, the two products shall be able to coexist with the caveat that the KUR budget doesn't go up significantly (relatively flat yoy growth for KUR ex housing in 2026).

KUR has proven to have better asset quality compared to Kupedes

KUR current gross CoC (excluding recovery from insurance) stood at 3.6%in 9M25 (3.4/3.9% in FY24/9M24), much better than Kupedes gross CoC of 6.8% in 9M25 (6.6/6% in FY24/9M24). This shall offset the differences in effective yield i.e. 18-19% for Kupedes vs. 16% for KUR.Our calculation suggests that KUR's ROA/ROE stood at 2.9%/48% whereas Kupedes's ROA/ROE stood at 4%/32%(fig. 8) - higher KUR ROE is due to lower RWA density. In sum, we believe that growth in KUR for the next 2-3 years is positive given the slower growth in Kupedes from asset quality issue.

Maintain Buy amid bottoming valuation

currently trades at 1.7x FY26 P/B and 8.7x P/E (vs. 10Y average of P/B of 2.4x and P/E of 14.7x) which we think may have hit the trough especially with minimal earnings revision.Biggest pushback that we receive is that the bank should trade at lower multiple as micro proportion will continue to decline(to 43-45%in 5 years from 47% average in 2022-2024) and replaced by consumer/corporate with lower ROA/ROE; we believe this partly has been priced-in as current valuation has hit -1 s.d. of its 10Y mean. Catalysts for the stock is pick-up in overall low-end purchasing power which shall help both micro loan growth and asset quality. Risks are lower margin fromdrop in loan yield and sticky CoF; along with worsening asset quality.

Sumber : IPS