Sector Update / Coal / Click for full PDF

Author(s) :Reggie Parengkuan,Ryan Winipta

- Weexpect 2Q24F NP to improve by +62% qoq but overall 1H24F to be below consensus (42%) due to lagging downgrade post 1Q results.

- Conversely, we expect 2Q24F NP to drop by -11% qoq but 1H24F still ahead of consensus at (65%) due to similar reason (lagging revision).

- We reiterate our sector Neutral rating as latest data still indicates ST bearish signal to price. is our top pick.

2Q24F preview: mixed trajectory; to see significant improvement

We estimate mixed 2Q24F earnings result from coal miners', despite expected higher sales volumes (+6-10% qoq) to offset rising cash costs from higher fuel price. is expected to see a significant improvement in NP (+62% qoq) driven by mining fee normalization and slightly higher ASP (+2% qoq). We forecast and 's NP to slightly improve in 2Q24F (+7/+1% qoq), attributed to Pama's margin expansion for and lower cash cost due to inventory movement for . On the other hand, 2Q24F NP is set to decline (-11% qoq) as lower ASP and higher cash cost more than offsets higher sales volume.

/UNTR to beat consensus, while /PTBA may come below

Despite expectation of relatively soft 2Q24F earnings, we anticipate 1H24F NP to still surpass consensus' FY24 forecast (65% consensus) due to limited consensus earnings upgrade (+9%) following a strong 1Q24 result (37% consensus). Conversely, and are set to underperform consensus (42/31%), despite better NP qoq from due to minimal earnings downgrade post weak 1Q24 result. In fact, consensus has since upgraded 's earnings estimates by 5% rather than a downgrade. Meanwhile, is expected to slightly beat consensus estimates (at 55%) as there were no revisions following its in-line 1Q24 earnings.

to offer the most attractive interim dividend

Based on our 1H24F earnings estimates, we expect /ITMG/ADRO interim dividend to yield 3%/6%/5% respectively. We derive this based on 30%/65%/40% payout ratio, in-line with long-term average. We expect dividend to be announced around Oct/Nov/Dec for /ITMG/ADRO.

Latest data still indicates ST bearish signal to price

We continue to see ST downside risk to China seaborne demand following a recent report of 6% mom increase in Jun24 coal production, after safety inspections were concluded in May24. Hydropower generation has also surged by 25% mom in Jun24 due to heavy rainfall, while wind and solar power generation has been gaining traction (1H24: +11/+35% yoy). To add, inventory in China/India also remains elevated at 17/17 days (9/51% above 3yr average). Upside risks to price include stricter mining safety regulation in China and La Nina in 4Q24F (report).

Reiterate Neutral rating on limited catalyst for a rally

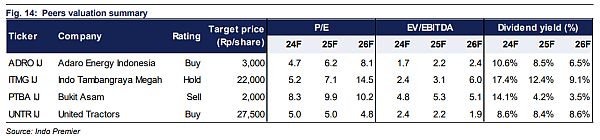

We maintain our sector Neutral rating for now given our ST bearish view on price. We continue to prefer and due to their attractive valuations of 4.7x and 4.9x FY24F P/E. At the same time, we do think could potentially outperform peers if coal price rallies on La Nina induced supply disruption, considering its strong correlation with Newcastle price and light positioning.

Sumber : IPS