Index Analysis / MSCI Index / Click here for full PDF version

Author(s): Ryan Winipta ; Reggie Parengkuan

- MSCI plans to assess Indonesia's market accessibility if there no transparency enhancements until May26 semi-annual index review.

- At the worst case scenario, Indonesia could be potentially reclassified from Emerging Market (EM) to Frontier Market (FM).

- JCI declined by -8.3% in two days since the announcement; However, downgrade to FM may require further steps, based on our case study.

MSCI : transparency concern may lead to frontier market downgrade

On Wednesday (28-Jan), MSCI announced that it will freeze all increases in Foreign Inclusion Factor (FIF) and number of shares (NOS), along with upward size-segment migrations from small-cap to standard-cap index in Feb26 review. This meant there would be no inclusion to MSCI Standard-Cap index in Feb26, but exclusion remains likely. Moreover, should there be no changes in transparency enhancements, MSCI will assess Indonesia's market accessibility and subject to market consultation, there could be weighting reduction in MSCI EM for Indonesian securities along with potential reclassification from EM to frontier market (FM).

US$10-11bn outflow likely; high foreign ownership stocks at risk

At the worst-case scenario (i.e. downgrade to FM), we estimate ~US$10-11bn net outflow from Indonesian market, mostly contributed by 18 companies that are currently a constituent of MSCI Standard Cap index. We think stocks with high foreign ownership could also be prone to further sell-off, as we expect several foreign mutual funds or insurance have the mandate to only invest in EM indices, but not FM. On percentage ownership basis, stocks that have the highest foreign ownership are , , , , , , , , , , and .

Outflow may not occur in May26 with potential overhang persist

Based on several case studies in the past, we think in order for Indonesia to be downgraded into FM, there would be further consultation with market participants, which meant that US$10-11bn potential outflow may not occur entirely in May26 - particularly from passive funds, as at this moment, no public consultation was made by MSCI related to potential reclassification for Indonesia from EM to FM. Nevertheless, we have seen active funds made pre-emptive move to frontload their selling shall the worst-scenario materialize, apparent in US$362mn net outflow on Wednesday, after MSCI announcement was made. Therefore, the uncertainty in regard to whether Indonesia would be downgraded into FM would continue to create an overhang to the market, at least in the near-to-medium term, in our view.

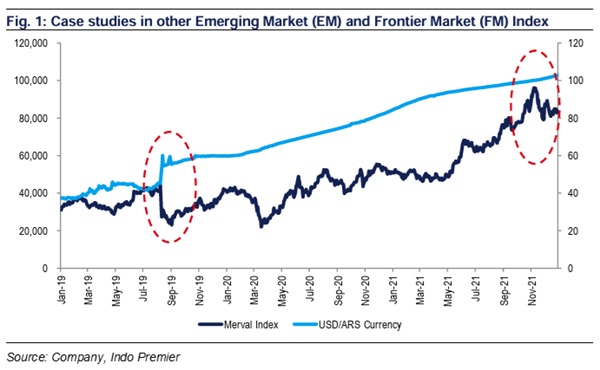

Past case-studies: no similarity to Indonesia

We have seen that previous EM to FM downgrade in the past (i.e. Peru, Pakistan, etc) often occurs due to inability for such market to fulfil several investability requirements to remain in EM based on MSCI methodology, such as: 1) having at least three companies - i.e. the case of Peru, 2) government's capital control - i.e. Argentina, and/or 3) "floor-price" rule - i.e. Pakistan. After the reclassification to FM, market indices in our case studies have declined by 17-48%, albeit we think the decline was primarily driven by non- MSCI related factors prior to its reclassification, rather than reclassification itself causing the decline in the index value.

Sumber : IPS