Strategy Update / Click here for full PDF version

Author(s): Jovent Muliadi ; Anthony

- Post 2Q results, we analyse what has been driving the outperformance. We found two major factors: earnings revision and 2H outlook.

- Vice-versa, weak outlook and downward revision have been the factor of underperformance thus far.

- Out of all sectors that we cover, we think currently banks may provide the biggest revision upside in 2H; and staples/commodities to some extent.

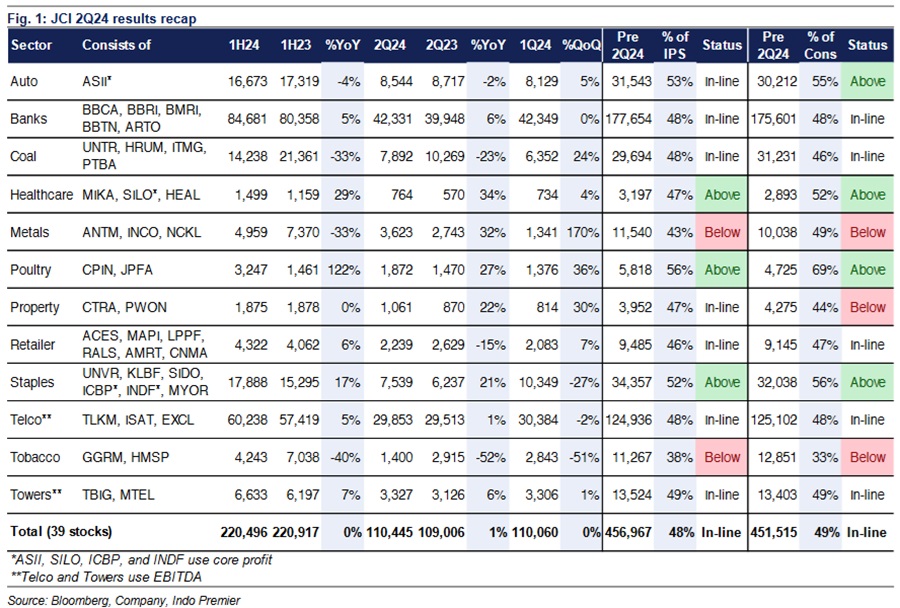

2Q24 results: an overall better quarter

Overall JCI results came in-line (flat yoy in 1H24 and +1% yoy/qoq in 2Q24) with ours/consensus estimates with few sectors beating estimates i.e. auto, healthcare, poultry and staples. On the other hand, metals and cigarettes came below (worth noting some of the metal/energy names haven't reported their results i.e. /MBMA/ADRO/ADMR). However, there are few sectors that reported in-line results but posted very weak share price performance i.e. telco and retailers which we think due to weak 2H outlook.

Earnings revision has been driving share price performance; only poultry, coal and healthcare has earnings upgrade

We observed that pre 2Q results, overall JCI earnings were revised by c.-4% by our analysts and also consensus. This brought FY24 JCI EPS growth to +1 to +2%. Concurrently, we believe that stock performance is actually pretty well correlated against earnings revision; few notable examples: retailers is expected to generate strong earnings growth of 24-30% yoy but consensus has downgraded earnings by c.-8% and this reflected in YTD performance of -9%. Similarly, overall banks posted in-line results in 1Q24 but downward revision in guidance which led to earnings downgrade (-3 to -7% revision) has been resulted in massive sell-off (SOE banks -14% mom post 1Q results). Coal, poultry and healthcare posted earnings upgrade (+3% to +21%) and was also reflected in the outperformance (+7-8% YTD). Biggest downgrade was on metals and tobacco at -18% to -26% similar to its underperformance.

Foreign flow is skewed towards punishing companies/sector with weak outlook

YTD Jul24, foreign recorded -Rp15tr of outflow despite recording Rp3tr of inflow in Jul24 alone. Banks recorded the biggest outflow of -Rp15tr, followed by auto at -Rp4.8tr and telco at -Rp2.4tr. In terms of company specific flow, recorded highest inflow of Rp6tr due to index inclusion, followed by at Rp4tr and at Rp3tr. and also recorded c.Rp1tr inflow. Consequently, /ASII/TLKM/BBNI recorded -Rp18/4.8/2.5/1.6tr of outflow - all companies are plagued by relatively weak outlook.

How to position for the remainder of the year: banks and to some extent staples along with commodities are our preferred picks

We believe banks outlook will only get better post 2Q results driven by lower CoC in BRI and better margin for the rests amid lower benchmark rate outlook (link); it also benefitted from multiple re-rating during lower rate cycle. Staples may get some tailwind from regional-election spending spill-over (although it may not be much considering the muted competition in regional election) while low input cost is also a boon (link). For commodities, we like base metals amid lower rate outlook/recession risk also coal due to strong results and cash flow (link). Our picks are: , , , , , and .

Sumber : IPS