Strategy Update / Click here for full PDF version

Author(s): Jovent Muliadi ;Anthony

- We are bullish with JCI on the back of: 1) rate cut cycle benefitting EM, 2) strong economic team in the cabinet and 3) possible beat in 3Q earnings.

- We expect staples and banks to deliver strong earnings, the latter from robust loan, better NIM and CIR especially for /BBRI.

- China outflow has also somewhat peaked as historically it amounts Rp7-8tr/0.08-0.15% of mkt cap vs. current outflow of Rp12.4tr/0.12% mkt cap.

Ample catalysts for JCI

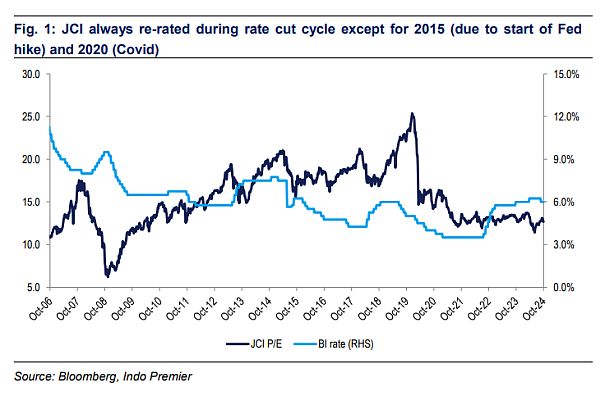

We think JCI is poised to re-rate this 4Q and next year given that: 1) rate cut cycle benefitting EM - note that JCI always re-rated during rate cut cycle except for 2015 (due to start of Fed rate hike) and 2020 (Covid), 2) strong economic team in the upcoming Prabowo's cabinet and 3) high possibility of beat in earnings given the low expectation - consensus expects only flat to +1% earnings growth.

Upcoming cabinet also suggests a strong economic team

Recent newsflow also suggested that there will be no major changes in the upcoming cabinet especially on the economic side; currently we expect both Minister of Finance and Minister of SOE (including the vice minister) to remain unchanged which shall also alleviate investors' concern on the budget discipline and changes in SOE's management.

JCI ex-/AMMN/TPIA valuation looks attractive

JCI currently traded at 12.7x P/E (ex-/AMMN/TPIA) vs. 10Y average of 16.6x and 2.0x P/B vs. 10Y average of 2.6x, an undemanding valuation in our view. Compared to other markets, JCI P/E currently trades at 31% premium against HSI vs. 10Y average premium of 58%; while at 39% discount against NIFTY vs. 10Y average discount of 6%. At the same time, we expect overall JCI earnings to improve to 6-7% in FY25F vs. flat to +1% in FY24F; this shall also suggest that 3Q24 earnings for our coverage to be at least in-line or slightly beating estimates i.e. staples and banks (strong qoq improvement).

Peaking foreign outflow; and looks attractive

We estimate that JCI recorded Rp12.4tr of foreign outflow since announcement of China stimulus on 24Sep (0.12% of market cap), however we think the outflow has peaked. We took cue back in two periods during China rally (2014-2015 SHCOMP up by 125% vs. JCI +7% and Apr-Jun22 SHCOMP up by 12% vs. JCI -4%) where the outflow amounted around Rp7-8tr or 0.08-0.15% of market cap. Concurrently, JCI recorded Rp1.7tr of inflow YTD, however if we exclude /AMMN/TPIA, JCI recorded a massive Rp7.3tr of outflow, this was largely contributed by at Rp19.4tr (2.7% of market cap, higher than Covid sell-off of 2.1% market cap), at Rp3.2tr, and at Rp1.2tr. We think out of those 4 stocks, we think and has the biggest upside from reversal of foreign flow.

Banks and consumer are our picks

We continue to like banks (/BBRI/BBTN) and consumer (especially staples) as we think both sectors provide the biggest earnings upside for this year and next. At the same time, we also like the top-down stories for both sectors: 1) main beneficiary of rate cut cycle (link to our note) for banks and 2) Government's focus on MSME i.e. free lunches and 3 million housing programs shall help to improve overall purchasing power/affordability.

Sumber : IPS