Non-rated / Metals / IJ / Click here for full PDF version

Author(s): Ryan Winipta ;Reggie Parengkuan

- Based on our channel-check, only two sizable players have obtained mining-quota ( RKAB ) approval YTD, including PT Timah ().

- While ' Apr24 & May24 indicative volume were below national export volume (Fig. 1), benefitted from higher tin price (+30% YTD).

- In addition, we think ' production cash-costs may structurally improve, should recent prudent approach in RKAB approval remains.

RKAB approval is imperative to illegal mining clampdown

During our group call with MIND ID and , ESDM has adopted more prudent approach and only granted mining-quota ( RKAB ) approval to tin-miners that fulfills all requirements (incl. ). Such practice is also apparent in other base-metal mining such as nickel, in order to avoid the previous illegal mining cases occurring in Mandiodo (nickel) and Bangka & Belitung (tin). Hence, we think the reform via RKAB approval is imperative to illegal mining clampdown asminers/smelters could not export their tin products without having RKAB approval.As of now, only c.55kt RKAB quota has been approved vs. >100kt in FY22 & FY23.

Indonesia tin export volume declined by 57% yoy in 5M24

As a result, coupled with ongoing investigation on illegal tin miners (report), 5M24 Indonesia tin exports have declined by 57% yoy to 10.3kt. Such low export volume has led to lower LME inventory (Fig. 3) with tighter supply reflected in +30% YTD rally in tin price. We think supply would remain tight following: 1) continuation of prudent approach in RKAB approval, and 2) planned maintenance in Yunnan and Jiangxi in Jun24 and Jul24 (c.30% global supply) due to low tin ore availability, positive to LME tin price.

Higher tin price has led to costs improvement & elevated cash margin

recorded US$10k/t production cash margin in 1Q24 owing to lower cash-costs of US$17k/t vs. ~US$21k/t in FY23. We thinkcash costs could structurally improvedue to higher bargaining power as could purchase tin ore (raw material) from Mitra Tambang at a lower price, as it doesn't have to compete with illegal private-smelters. As of now, only two sizable players - incl. , have obtained RKAB approval.

Production may pick-up in 2H

Our discussion with management indicates that ' average monthly production volume was around 1.4-1.5kt in 2Q24F due to weather-related issues with a target to increase monthly production to 2kt in 2H24F. Hence, our calculation indicates that at current production run-rate and ASP level (US$32k/t), is valued at 6x FY24F P/E. In the optimistic scenario, taking into account 2kt monthly production/sales in 2H24F, is currently valued at only 4x FY24F P/E - lower than peers valuation (Fig. 7).

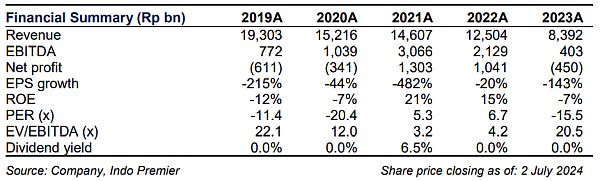

Sumber : IPS