Sector Update / Coal / Click here for full PDF version

Author(s) : E rindra Krisnawan ; Reggie Parengkuan

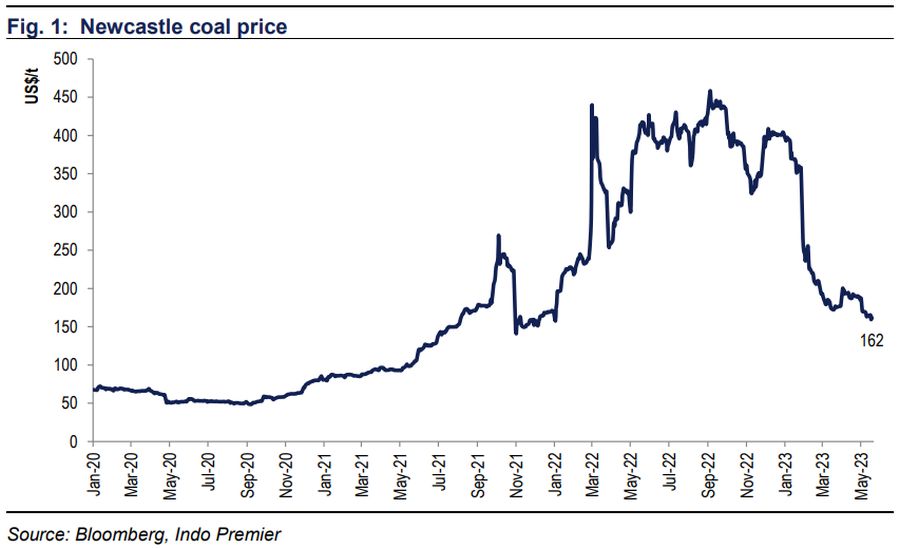

- Thermal coal price seasonal correction has been exacerbated by recent concerns over China's softer demand and higher domestic production.

- Coal miners' performance and FY23 guidance indicated earnings may have peaked in 1Q23, as cost will rise vs. the anticipated softer ASPs.

- Despite already reduced funds' positioning, we think it's too early to dip back into the sector until 2Q23 earnings drop is seen; maintain Neutral.

Coal price correction is expected, but softer demand adds pressure

Coal prices correction recent weeks (Newcastle price falling to US$162/t as of last week or -59% YTD, while Indonesian indices ICI3 and ICI4 falling to US$92/t and US$69/t or -19 and -21% YTD) has thus far been in-line with our view ( link to report ), which was predicated on expectation of supply increase. Nonetheless, recent industry newsflows indicated additional concerns from a combination of soft domestic demand in China (in-line with soft data point in industrial activities) and India, and rising production in China (+5% as of 4M23).

Softer Apr23 imports; China seasonal summer demand may be at risk

While 4M23, coal trade (based on Bloomberg data) still recorded 11% yoy to 377Mt in 4M23; Apr23 trade have showed a continued slowdown (Apr 3mMA -3% mom) mainly reflecting slowing imports across markets exChina and India (i.e., JKT -12% mom, ASEAN flat mom, Europe -9% mom). Despite still steady import from China and India, we see still sufficient inventory and available supplies from domestic markets to be the driver behind the price softening.

Coal miners' earnings may have peaked in 1Q23

The coal miners' 1Q23 results and management guidance indicate earnings may soften further in the coming quarters on the combination of: 1) 1Q23 coal ASPs were generally still ahead of expectation, reflecting the still resilient Newcastle and ICI prices at end of 4Q22/1Q23, but a more severe price corrections in early 2Q23 may start to impact 2Q23. 2) Higher 1Q23 costs, notably from higher royalty (mainly on higher govt's coal refence price), mining fee and higher stripping ratio. We expect these to offset FY23 production volume growth plan (2-11% yoy).

Maintain sector Neutral rating

Reduced funds' positioning on the sector (currently neutral weighting vs. JCI, except for ) and possibility for seasonal price pickup due to summer demand suggested price pressure may be limited. However, we think it is too early to dip back into the sector until we see the extent of 2Q3Q23 earnings decline and impact of China economic slowdown in coal prices. We thus maintain Neutral rating on the sector, with preference on (Buy, TP Rp29,700), as we expect its contracting business to benefit from the resilient mining fee and rising SR.

Sumber : IPS