Sector Update / Coal / Click here for full PDF version

Author(s): Erindra Krisnawan ;Reggie Parengkuan

- We see market balance turn into a higher surplus in 2H23 attributed to lower import demand amid higher China and India domestic production.

- Expect 2Q23 to be weak as soft ASP more than offset higher volume.

- In our view, recent rebound in coal stocks was mainly attributed to expectations on China recovery, though fundamentals remain soft.

Jun23 data: China slowing down while Russian supply picking up

Coal trade improved by 11% yoy to 592Mt in 1H23 with China recording the strongest growth of 121% yoy as it seeks to stock up amid economic reopening, followed by ASEAN at +9% yoy. This has more than offset soft import from Europe (-31% yoy) attributed to declining gas price and JKT (-10% yoy). On a monthly basis, coal trade remained flat mom in Jun23, and up by only 2% yoy. ASEAN and JKT demand picked up (3MMA: +17/+10% mom) but was offset by lower China and India imports (3MMA: -5/-11% mom). Additionally, Russian seaborne supply increased 9% yoy in 1H23.

2H23 supply-demand may turn FY23 market into higher surplus

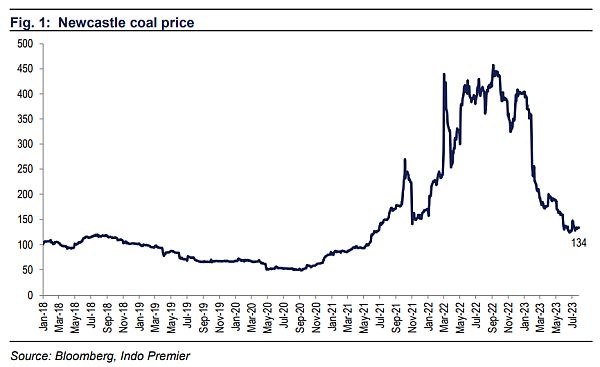

Although China's seaborne demand growth in 1H23 (annualized: +54% yoy) is well ahead of our forecast, this was well met with steady increase in domestic production (+5% yoy) and Indonesian seaborne supply (annualized: +13% yoy). Meanwhile, demand from India came short of our expectation (1H23: flat yoy).Going into 2H23, we see downside risk to China's seaborne demand on rising domestic production (1H23: +5% yoy). Though we see upside room for India demand (FY23F +4% yoy vs. 1H23's flat yoy), though this may still be behind our forecast. On supply front, we expect Australia and Indonesia supply to continue to pick up and thus tip the market balance into a higher surplus of 8Mt (from 5Mt prev.). Consequently, we cut our Newcastle/ICI4 forecast to US$175/65 (vs. US$240/75 previously)

2Q23 preview: expect a weak quarter

We expect 2Q23 earnings to be soft as weak coal prices may more than offset higher volumes. Amid Newcastle steeper decline (-37% qoq) compared to ICI4 (-16% qoq), we expect and to be the weakest performers qoq. We expect cash cost to trend down by 5-12% amid declining fuel price and lower royalty. Combined with moderate 10% qoq volume growth in 2Q23, we expect coal miners to record +12% to -66% qoq growth. Despite this, we expect 1H23 EBITDA of /UNTR to be ahead of our/consensus FY23 forecast, while the others are slightly below.

Maintain sector Neutral rating

In our view, the rebound of 17-27 % in Indonesian coal stocks (excl. : -8%) since Jun23 was mainly fuelled by expectations on China and the pick-up in coal futures (+16-18% in the past 2 weeks). However, trading activities in the physical market remains subdued, according to newsflow. As we expect market balance tipping into a higher surplus in FY23, we see more downside risk in ICI4 compared to Newcastle. If materializes, we estimate 3Q23 earnings to decline by 3-8%. We maintain Neutral on the sector, favouring on defensive earnings profile and on further monetization of nickel assets.

Sumber : IPS