Company Update / Coal / IJ / Click here for full PDF version

Author(s): Reggie Parengkuan ; Ryan Winipta

- plans to spin-off thermal coal assets through IPO with US$2.4-2.6bn valuation while also distributing dividend (c.34% yield).

- We expect upside from dividend distribution, thermal-coal IPO (only at FY24F 2x P/E), and unlocking renewable valuation on level.

- Maintain our Buy rating at unchanged SOTP -based TP of Rp3,900 for now, but we will revisit our estimates once more details are available.

to spin-off thermal assets and distribute dividend

plans to spin-off its thermal coal business by listing its 99.99% stake in Adaro Andalan Indonesia (AAI) through IPO at US$2.4-2.6bn valuation. Shareholders registered on a certain date (TBA) will obtain the rights to subscribe to AAI's IPO at a ratio that remains undetermined. Additionally, will also distribute dividend after EGMS which we estimate at c.34% yield (at Rp3,670 price)which can be used to subscribe to AAI 's IPO.

Potential downside to share price after spin-off

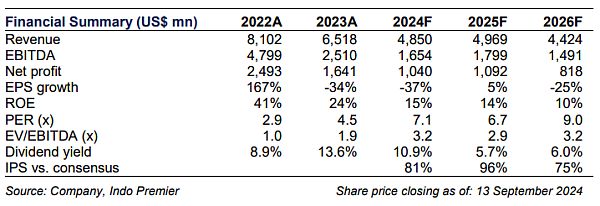

Post transaction, (84% stake) and Adaro Green (100% stake) will be 's primary earnings driver. Among the key investor concerns are the potential downside to share price post-dividend and AAI rights subscription date. In theory, there shall be c.18% downside to share price based on SOTP valuation of US$6.1bn (Fig. 1), but should the market decide to not value the green business given its relatively nascent stage, we see c.35% downside. However, we think the downside to share price could be buffered from AAI's IPO.Positively, AAI valuation of US$2.4bn implies an attractive 2x FY24F P/E, and we see net upside of 22-39% ( + AAI) if we assume AAI will re-rate to 4-5x FY24F P/E, in-line with coal peers valuation.

The transaction is a long-term +ve, in our view

Despite potential downside in ST, we think transaction is a long-term +ve as we see a re-rating to share price from: 1) purchasing additional renewable assets, which could generate more cash flow to , 2) unlocking renewables valuation as renewables capacity are being ramped-up, while 3) obtaining premium multiples owing to its renewable exposures, which are much higher vs. thermal coal business valuation (Fig. 2 & 3).

Maintain Buy at unchanged SOTP -based TP of Rp3,900

We maintain our Buy rating at unchanged SOTP -based TP of Rp3,900 for now and will revisit our estimates once more details on this transaction are available such as: 1) AAI's IPO subscription rights ratio in relation to ownership in , and 2) dividend payout ratio and yield, pending EGMS on 18thOct.

Sumber : IPS