Sector Update /Consumer Staples / Click here for full PDF version

Author(s): Lukito Supriadi ;Andrianto Saputra

- 1H24 results saw strong profit beats (except ) across our staples coverage - , , and .

- Nonetheless, contrasting macro data (three months of deflation from May24-Jul24) and decline in CCI may indicate softer buying power.

- Incremental buyer for staples is contingent on foreign flow as local funds are very well positioned. Maintain sector Neutral call.

2Q24: strong beats across our coverage with the exception of

We have seen an encouraging recovery in 2Q24 domestic sales growth across aggregate consumer staples (ex-) at 11% yoy, which we believe is driven partially by the multiplier effect of the election spending spill over. For bottom-line attainment, 4 out of 5 names (, , , ) reported stronger than expected results as raw material price trends are generally conducive for margins.

Contrasting macro data indicate soft buying power

Mass market buying power, however may be softening as indicated by the three consecutive deflationary months from May24-Jul24 (linkto our economist note) and Jul24's PMI data of 49.3. This is also reflected in the decline of consumer confidence index (CCI) from Apr24's 127.7 to Jun24's 123.3 - the decline of which is most apparent for consumer with spending level

Inferring from Jul24 KSEI data, local funds are generally well-positioned across staples names with alphas (inferred local fund weight - JCI index weight) reaching record high levels for some names such as , , (Fig. 7-12). As such, we view incremental buyers of the sector shall be contingent on foreign flow, as some investors await regulatory clarity until the new administration's inauguration and the new cabinet is finalized.

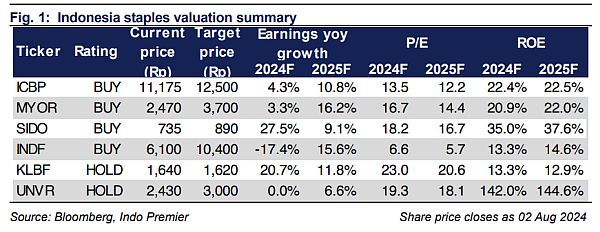

Maintain sector Neutral rating

In spite of the unsupportive macro data, it is worth noting that 3Q23 represents a soft base for consumer staples in general. Recall that 3Q23 revenue grew only +1.5% yoy/+9.5% qoq. In sum, we maintain our sector rating at Neutral whilst reiterating BUY calls for top picks (, , ). Our pecking order for staples post 2Q results is as follow: > > > > > .

Sumber : IPS

powered by: IPOTNEWS.COM