Company Update / Gas / IJ / Click here for full PDF version

Author(s): Reggie Parengkuan ;Ryan Winipta

- reported 1Q24 NP of US$10mn (+228% yoy/-59% qoq) ahead of our forecast, driven by higher ammonia margin.

- At current valuation, we strongly believe investors are beginning to factor in company's long term plan to double its current capacity.

- We maintain our Hold rating at upgraded TP of Rp700/sh to reflect +21/+24/-25% earnings adjustment in FY24-26F and capacity addition.

1Q24 earnings was a beat on higher ammonia margin

1Q24 net profit improved to US$10mn (+228% yoy) on yoy basis which came ahead at 34% of our FY24F forecast driven by higher ammonia margin (+1,994 bps yoy), but declined qoq (-59% qoq) on the back of lower ammonia price (1Q24 avg: US$355/t, -32% qoq). The earnings beat in 1Q24 was primarily driven by a combination of higher-than-expected ammonia plant utilization rate of 122% (vs. 115% IPS) and ASP of US$344/t (-51% yoy/31% qoq). On qoq basis, interest expense rose by +28% qoq despite US$26mn debt repayment, as some amounts of interest expenses that should be reported in 4Q23, is recorded in 1Q24 instead, due to accounting reason.

Ammonia price remained weak despite rising gas price

Despite Europe's record high gas storage level, the Dutch TTF gas price has recently surged to $34/MWh (c.+38% from bottom in Feb24) due to recent geopolitical tension between Iran-Israel and Russia-Ukraine. While these events have not actually shifted gas supply dynamics, traders are starting to hedge against an all-out war scenario and buy into gas option contracts. As a result, US Henry Hub gas price and ammonia price has lagged behind the Dutch TTF gas by 18/45%. In our view, ammonia price will only catch up if US gas price follows suit or war tension intensifies.

Valuation ahead ST fundamental as market pricing in higher LT volume

is currently trading at 24x FY24F P/E (80-140% premium to regional peers), ahead of its short-term fundamentals as we strongly believe investors are beginning to factor in company's long term plan to double its current capacity (650kt). Assuming blue ammonia premium of US$100/t and LT price assumption of US$300/t, it would take c.500kt capacity expansion in FY30F to justify 's current market value.

Maintain Hold rating with a higher TP of Rp700/sh

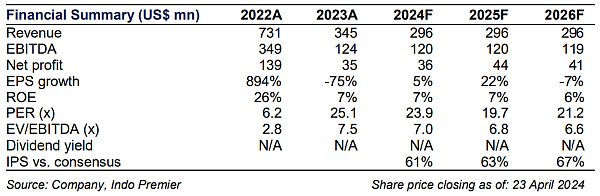

We maintain our Hold rating given the soft industry backdrop and unattractive valuation. However, we have raised our TP to Rp700/sh (from Rp600/sh previously) to reflect capacity addition of 300kt in FY30F to reflect 's long term plan. We have also adjusted FY24/25/26F earnings forecast by +21/+24/-25% on higher utilization rate assumption and delayed blue ammonia production.

Sumber : IPS

powered by: IPOTNEWS.COM