Non-rated / IJ / Click here for full PDF version

Author(s): Lukito Supriadi 6;Andrianto Saputra

- After years of aggressive retail store roll-out, is planning to scale back the store expansion in FY24F and focus on productivity instead.

- More affordable handset offerings from principals (post chip shortage normalization) may be the key to improve Erafone store productivity.

- Handset principals are prioritizing retailers' margin over distributors'; net positive for with higher retail sales contribution.

Focusing on store productivity as FY24F Lebaran shows improvement

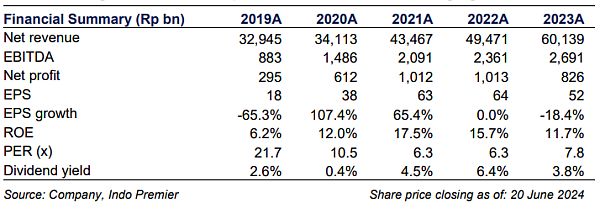

Our recent discussion with recently suggests that it shall focus on improving store productivity whilst scaling down store expansion to c.200 stores (vs. FY22/23's 575/629 gross store addition). We view this to be a rationale decision noting the higher average opex/sales ratio in FY22-23 of c.7.8% opex/sales ratio vs. pre-pandemic FY18-19's average of c.6.2%. At the same time, the 2Q24 Lebaran festive has shown improved sales performance compared last year's Lebaran.

More affordable handset rollout is key to improve store productivity

Encouragingly, we are seeing more affordable handset rollouts in 1Q24 (>10 affordable SKU rollout vs. 5 in 1Q23). This results in 's handset volume rising +25% yoy in 1Q24, whilst handset ASP declined by c.9% yoy. Considering the current soft buying power backdrop, more affordable handset offerings is imperative to drive Erafone store productivity.

Updates on other verticals diversification - Lifestyle and F&B

's initiatives in diversifying into other verticals apart from handset have seen the addition of "Bacha Coffee" and "Curry Up". Additions to F&B and fashion sub-segment have resulted in higher 'Accessories and others' segmental GPM to 25.3% in 1Q24 (vs. 20.6% in 1Q23). Discussion on potential JD Sports' consolidation is still on-going and may be finalized in 2H24. All else being equal, JD Sports shall boost sales by mid-single digit at Erajaya Lifestyle () level upon consolidation or 0.7% of FY23 sales accretion at 's level. More importantly, this shall allow greater flexibility to rollout more JD Sports stores - currently capped at minimal size of 400m2 due to foreign ownership in the JV.

Handset retailers' margin prioritized by principals over distributors'

Recently, handset principals in general are prioritizing margins at retailers' level instead of distributors'. Considering 's FY23/1Q24 retail sales contribution of close to 70% (vs. FY22's c.65%), the shift in prioritization from principals may bode well for - especially noting their aggressive retail store rollouts in recent years. Going forward, we view 's success hinges on their initiatives to improve store productivity and diversify into other verticals, whilst sticking to financial discipline that includes de-leveraging.

Sumber : IPS

powered by: IPOTNEWS.COM