Company Update / Gas / IJ / Click here for full PDF version

Author(s): Reggie Parengkuan ;Ryan Winipta

- reported 1H24 NP of US$21mn (+418% yoy), ahead of ours/cons forecast (57/54%) driven by better than expected ammonia ASP.

- ASP decline (-3% qoq) was surprisingly better compared to benchmark (-22% qoq); while other operational data was in-line.

- We maintain our Hold rating at unchanged TP of Rp700/sh on potential 3Q24F earnings decline, pending on further clarity from earnings call.

1H24 earnings was a beat on higher ammonia ASP

1H24 NP of US$21mn (+418% yoy) was ahead of ours/consensus estimates at 57/54% respectively. This was primarily driven by higher-than-expected ASP (106% of IPS). On a quarterly basis, 2Q24 earnings improved to US$10mn (+2% qoq/+1102% yoy) on the back of less severe decline in ammonia ASP (-3% qoq) compared to benchmark (-22% qoq), in addition to higher ammonia sales volume (+9% qoq). Despite significantly lower ammonia margin (-567bps qoq), net margin only declined by 49bps qoq on lower opex (-18% qoq) and interest expense (-29% qoq).

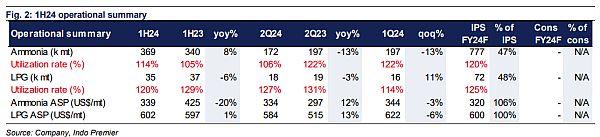

Operational data in-line; ASP surprised

2Q24 ammonia sales volume remained strong at 198kt (+9% qoq) despite a decline in production volume to 172kt (-13% qoq) due to 5 days of unplanned maintenance in May24. ASP only declined by 3% qoq to US$344/t, while the Middle-East (MDE) price benchmark declined by 22% qoq. We think that the tepid decline in 's ASP was in-line with Fertecon ammonia prices benchmark which usually lags by c.1 month, and as such, we see a potential downside risk to 3Q24F ASP. Separately, higher LPG production in 2Q24 (+11% qoq) offsets lower ASP (-6% qoq). Overall, operational was in-line with our estimates (Fig. 2) with ammonia ASP being the exception (106% IPS).

ST downside risk as share price outperforms gas price

We have recently seen a divergence between gas and ammonia price in Mar-Apr24 (Fig. 3) as ammonia price tends to lag the movement in gas price. However, as share price rallied along with natural gas price vs. more earnings-reflective MDE ammonia price (Fig. 5) - likely due to limited natural gas equity plays in Indonesia, we see short-term downside risk to share price.

Maintain Hold rating with an unchanged TP of Rp700/sh

We maintain our earnings for now on the back of potential earnings decline in 3Q24F on lower ASP, pending further clarity from their earnings call and maintain our Hold rating with unchanged TP. is currently trading at 28x FY24F P/E (128% premium to regional peers' average). Downside risks include continued short-term downtrend in gas price attributed to lower demand in Asia, Europe, and US on still higher than average temperature.

Sumber : IPS

powered by: IPOTNEWS.COM