Sector Update / Metals / Click here for full PDF version

Author(s): Ryan Winipta ;ReggieParengkuan

- Positioning has been relatively lighter on both commodity and equities - nickel at net short while local funds trimmed metals' equities position.

- However, risks on softer demand may loom with soft reading in U.S and China economic activity, i.e. China PMI dip <50 in May24 and Jun24.

- We maintain our preference on precious metals > energy > base metals following higher possibility of a rate-cut by US Fed & recession risks.

Commodities positioning has been relatively lighter vs peak in May24

Base metals' positioning has come down from its peak in May24 with LME nickel already at a net-short of 10k contracts as of early Jul24 (Fig. 2) from net long in May24. Albeit, speculators remained a net-long in copper but at a lesser magnitude vs. YTD peak (Fig. 3). At the same time, on commodity equities side, local funds positioning has declined after the price correction on the underlying commodity i.e. nickel -23%, copper -11% off-peak, suggesting lighter positioning and better upside shall there's any positive macro-development and change in supply-demand (S-D).

Risks on softer demand has been apparent across US and China

While there's a higher likelihood of rate cut (Fig. 8), this may also meant that underlying economic activity are soft. For instance, US unemployment rate has been picking up to above c.4% while part-time labours were going up and permanent labour were on the decline. Energy prices may remain sticky as OPEC export declined in Jun24 and MTD - prompting higher recession risks due to high energy prices amid soft economic activity. Additionally, China's economy has been soft with PMI reading of 49.5 in May24 and Jun24 with steel-consumption on the declining trend.

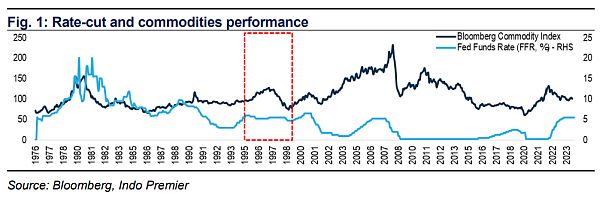

Rate cut historically been +ve for precious metals, -ve for base-metals

Previous rate-cut cycle has been positive for precious metals - especially during 2008's GFC & Covid-19, but is negative for base-metals. But, in the event of soft-landing (similar to1995-1996s 75bps rate cut), commodities on aggregate have performed by +30-40% as economic activities were resilient. While softer demand is already apparent globally - underpinning our preference for precious metals, we think base metals price correction won't be as significant as previous rate-cut, driven by lighter positioning (in nickel) & structurally low supply growth (in copper).

Maintain our preference on precious metals &

Hence, we maintain as our top pick due to its gold-exposure. Note that gold price has been relatively resilient and rallied to US$2.4k/oz after US CPI data overnight, while energy are relatively flattish, and base metals such as copper are down by 2%. Downside risks include recession risks (for energy & base metals) and potential hard-landing scenario.

Sumber : IPS

powered by: IPOTNEWS.COM