Company Update / Consumer Staples / IJ / Click here for full PDF version

Author(s) : Lukito Supriadi ; Andrianto Saputra

- Post the pandemic, we believe is a good proxy to ride on Indonesia'sgrowing consumption and premiumization theme.

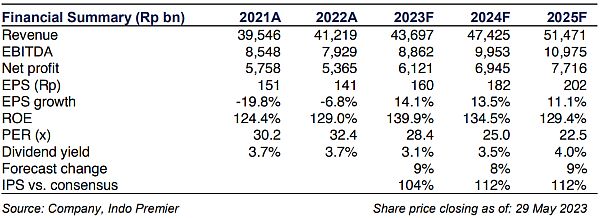

- We revised up our FY23/24F earnings forecast by 8.8/8.2%, implying 14.0/14.6% yoy growth.

- We upgrade our rating to Buy at higher TP of Rp5,600

Conducive macro backdrop translates to structural tailwinds for

Given 's product pricing premium in general (c.19-26% over peers), we view that 's revenue was adversely affected during the pandemic on the back of purchasing power decline and evident mass-market consumers' shift to value product proposition. With the pandemic well behind us, Indonesia's consumption growth story is back on track with 6.7% in disposable income/capita FY22-25F CAGR expectation, based on Euromonitor. This would translate to increased FMCG spending/household, potential reversal of the downtrading trend and implies ample room for further penetration in some FMCG categories (for e.g. penetration for post wash hair care at <20%, liquid body soap at <60%). Interestingly, 's 1Q23 sales of its premium segment, which accounts for c.22-25% of the business, grew a stellar 17.7% yoy - implying that can be a proxy to capture the premiumization trend.

FY23/24F forecast upgrade

Consequently, we upgrade 's FY23/24F revenue to Rp43.7/47.4tr (+0/2% from previously) reflecting the improved macro outlook. Do note there was still channel transformation affecting sell-in performance in 1Q23 of -2.2% yoy and is expected to improve in the remaining quarters. Our GPM assumption is revised up by c.250bps from previously to 49.2/49.7% for FY23/24F following 1Q23's positive surprise and the view that most raw material costs would continue to normalize in FY23F with the exception of sugar. FY23/24F opex forecasts are revised higher (from 29.7/29.1% of sales previously to 30.9/30.6% of sales) primarily from higher A&P spend, which is imperative to maintain and possibly grow its market share. Hence, our net profit forecast is adjusted to Rp6.1/6.9tr (+8.8/8.2% from previously)

Upgrade to Buy with higher TP of Rp5,600

In sum, we upgrade our rating to Buy (from Hold previously) following 's upgraded forecast for FY23/24F. Our TP of Rp5,600 was based on 32.8x fwd-12M (at average FY23-24F) P/E (-1 s.d. below its 5Y mean), a slight re-rating from -2 s.d below mean previously due to earnings inflection in FY23F after three consecutive years of earnings decline (FY19-22) and potentially return to net profit CAGR of 12.8% between FY22-25F.

Sumber : IPS

powered by: IPOTNEWS.COM